Pay Anyone, Anytime, Anywhere

Effortlessly send, receive and the request of funds online by Translink with tailor-made solutions designed to meet your special business requirements

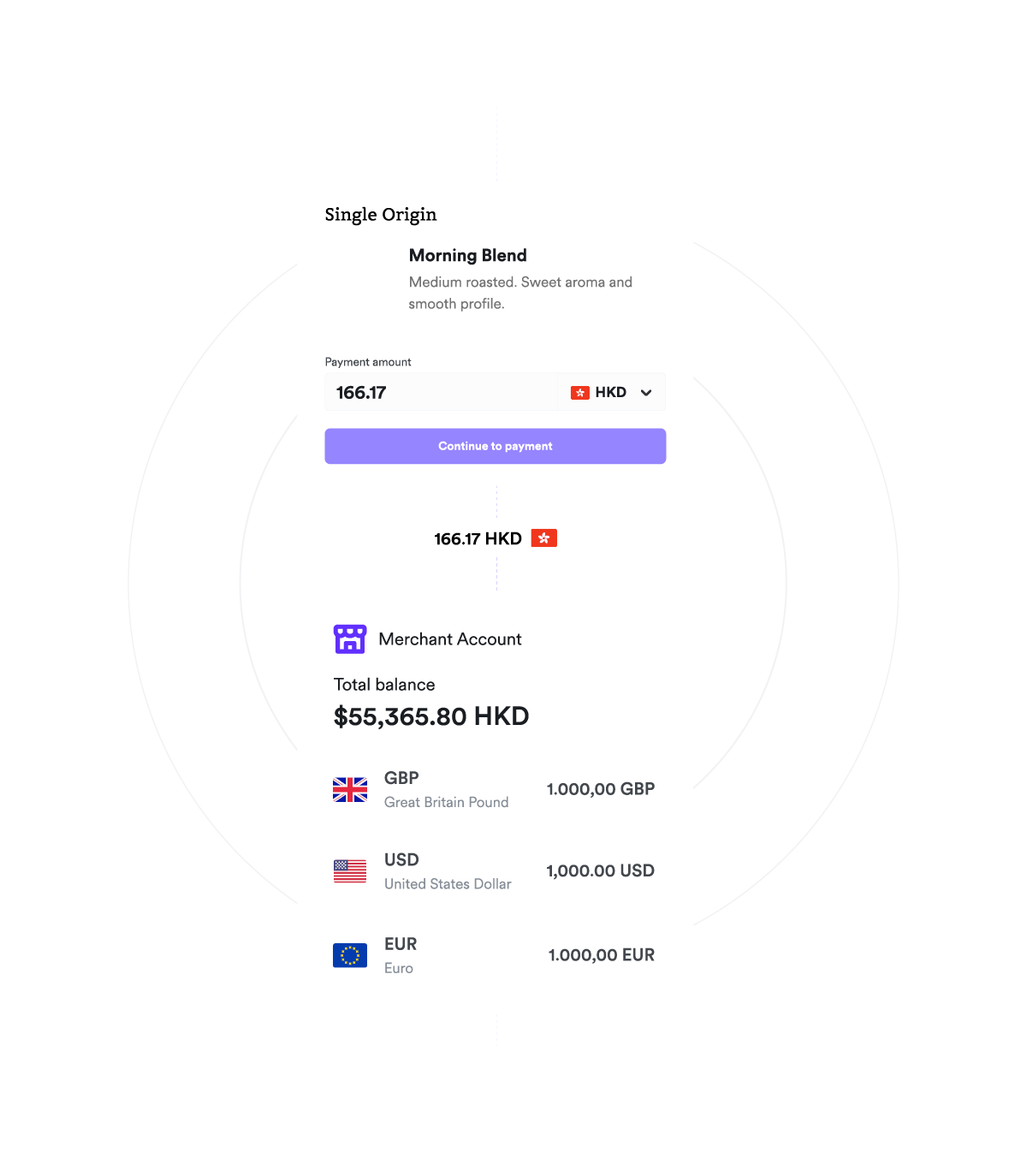

E-Wallet that answers all your needs

Professional services

Accept payments from global clients and give your customers the flexibility to choose their preferred payment methods.

Wholesale & trading

Designed for modern B2B and B2C wholesalers seeking to receive online payments without the burden of extra telegraphic transfer (TT) fees or excessive foreign exchange (FX) charges.

E-commerce

Receive payments in over 180 currencies globally and boost conversions by offering your customers more than 160 local payment methods in their own currencies, like Alipay and WeChat Pay.

A modern payment platform designed to help you grow and secure your global revenue.

From e-commerce stores and subscription services to online marketplaces and platforms, businesses of all sizes trust Translink to expand globally, avoid unnecessary currency fees, and safeguard against fraud.

-

Accept payments in 180+ countries with 160+ payment methods Increase checkout conversions by offering local currency pricing and allowing customers to pay with their preferred payment methods.

-

Eliminate costly FX conversion fees with like-for-like settlement Collect and settle funds in the same currency without the hassle of setting up multiple entities or paying hidden conversion fees.

-

Reduce chargebacks with built-in fraud prevention Automatically identify suspicious transactions and reduce chargebacks with built-in fraud detection and dispute management.

-

Minimise FX risk with Multi-currency pricing Lock in FX rates for up to 72 hours when you price in local currency to safeguard against FX fluctuations.

Reduce expensive FX fees with same-currency settlements.

-

Get paid without hidden fees Avoid unnecessary currency conversion fees when you receive funds in the same currency that your customers pay in.

-

Collect funds into multi-currency accounts Collect funds into multi-currency accounts and securely hold funds for future payments to local suppliers.

-

Pay suppliers in local currency Make fast, cost-effective transfers to local suppliers or easily make local purchases with Translink Borderless Cards.

Additional features to drive performance

Network tokenisation

Translink replaces PANs with network-issued tokens to enhance card acceptance rates and lower processing costs.

Saved payment details

Drive repeat sales by initiating payments based on your customers’ saved payment details.

Direct network integrations

Benefit from our full-stack payments platform that directly integrates with all major card scheme networks.

Choose the best integration path for you

Integrate in several ways ranging from using a pre-built integration to developing your UI for full control over your checkout experience.

-

No-code E-commerce Plugins

Access our simple plug-and-play integrations with popular platforms like Shopify, WooCommerce, and Magento. -

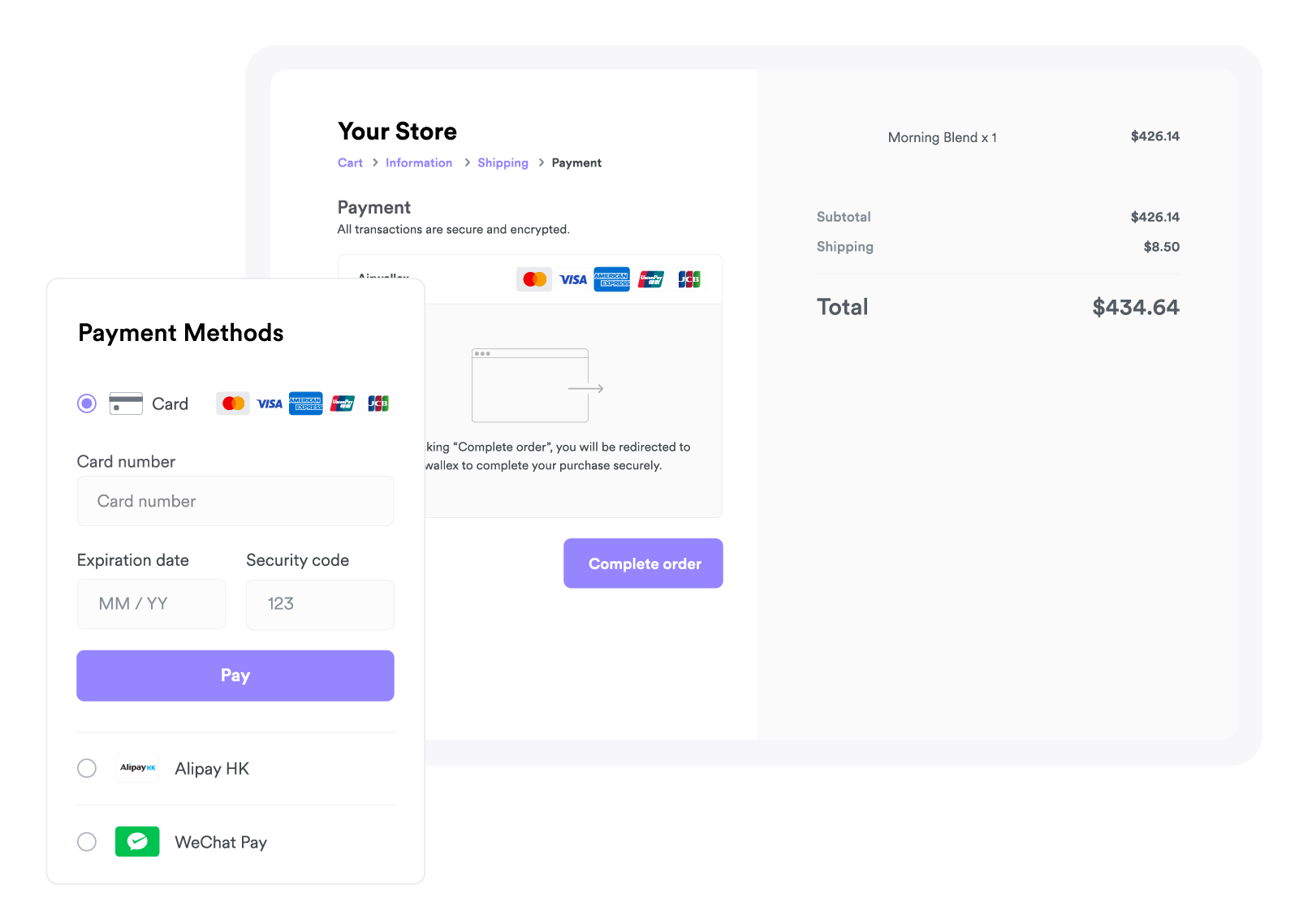

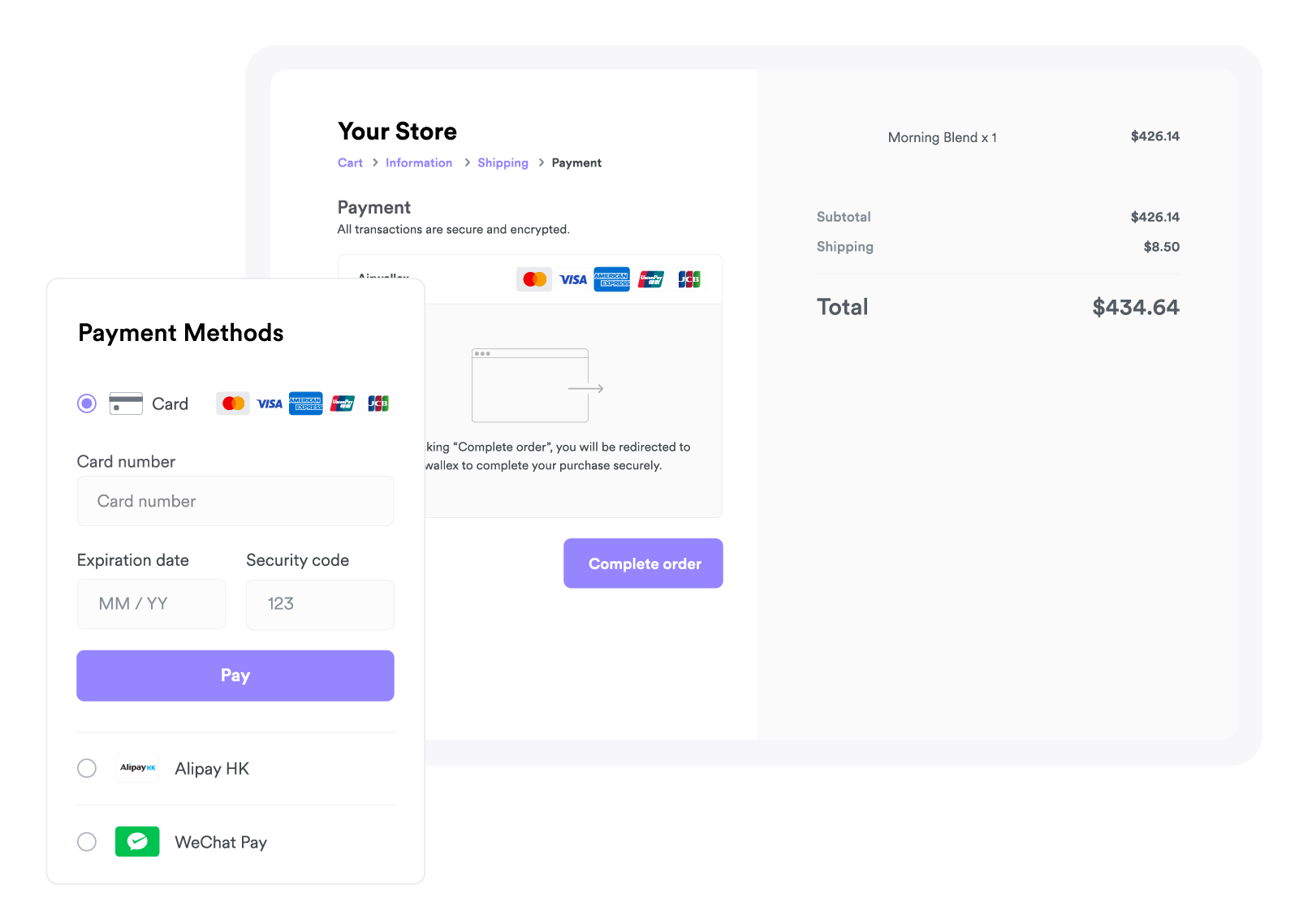

Hosted Payment Page

Save on development resources by redirecting customers to an Translink-hosted page on your own web store. We take care of the whole payments journey. -

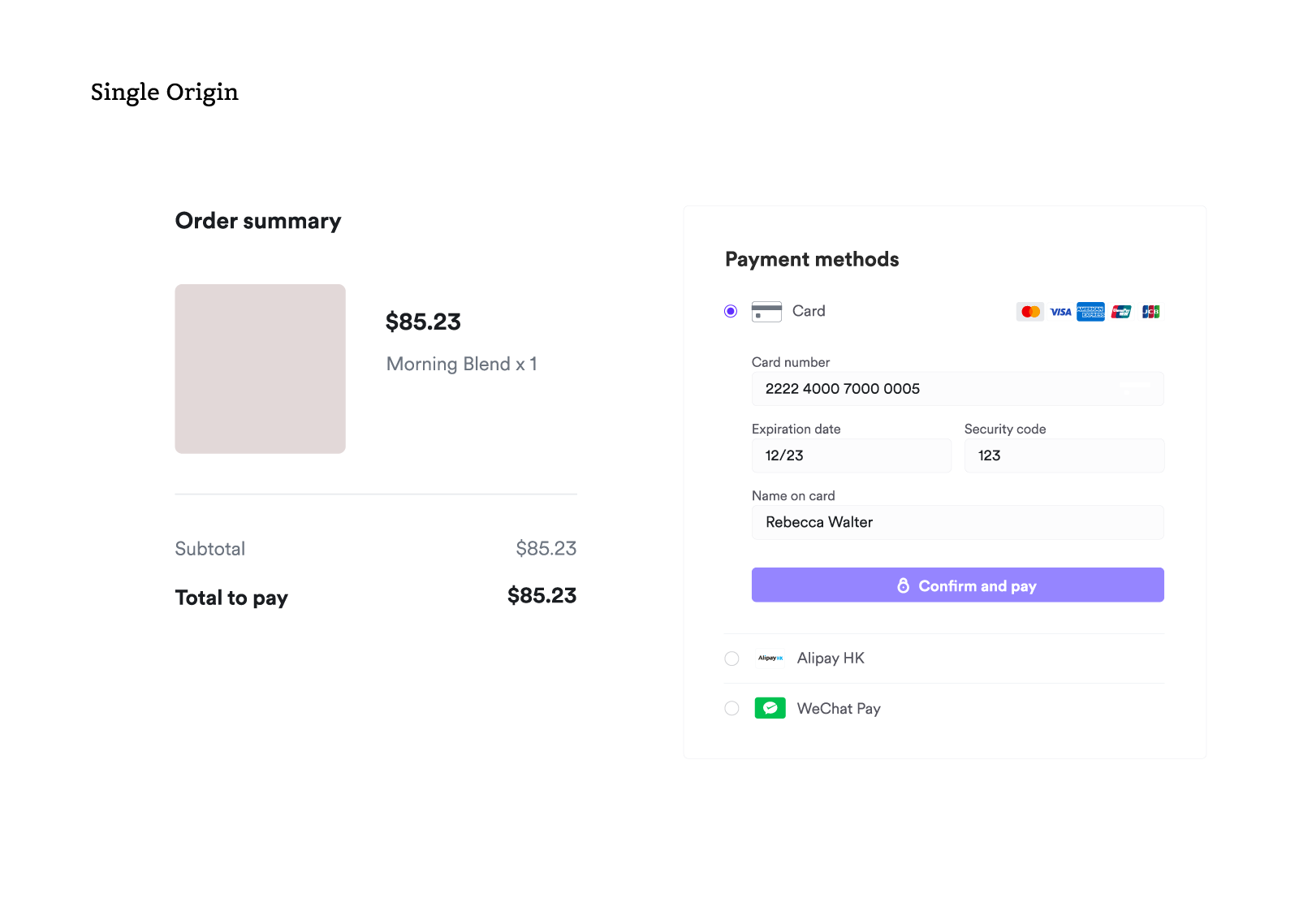

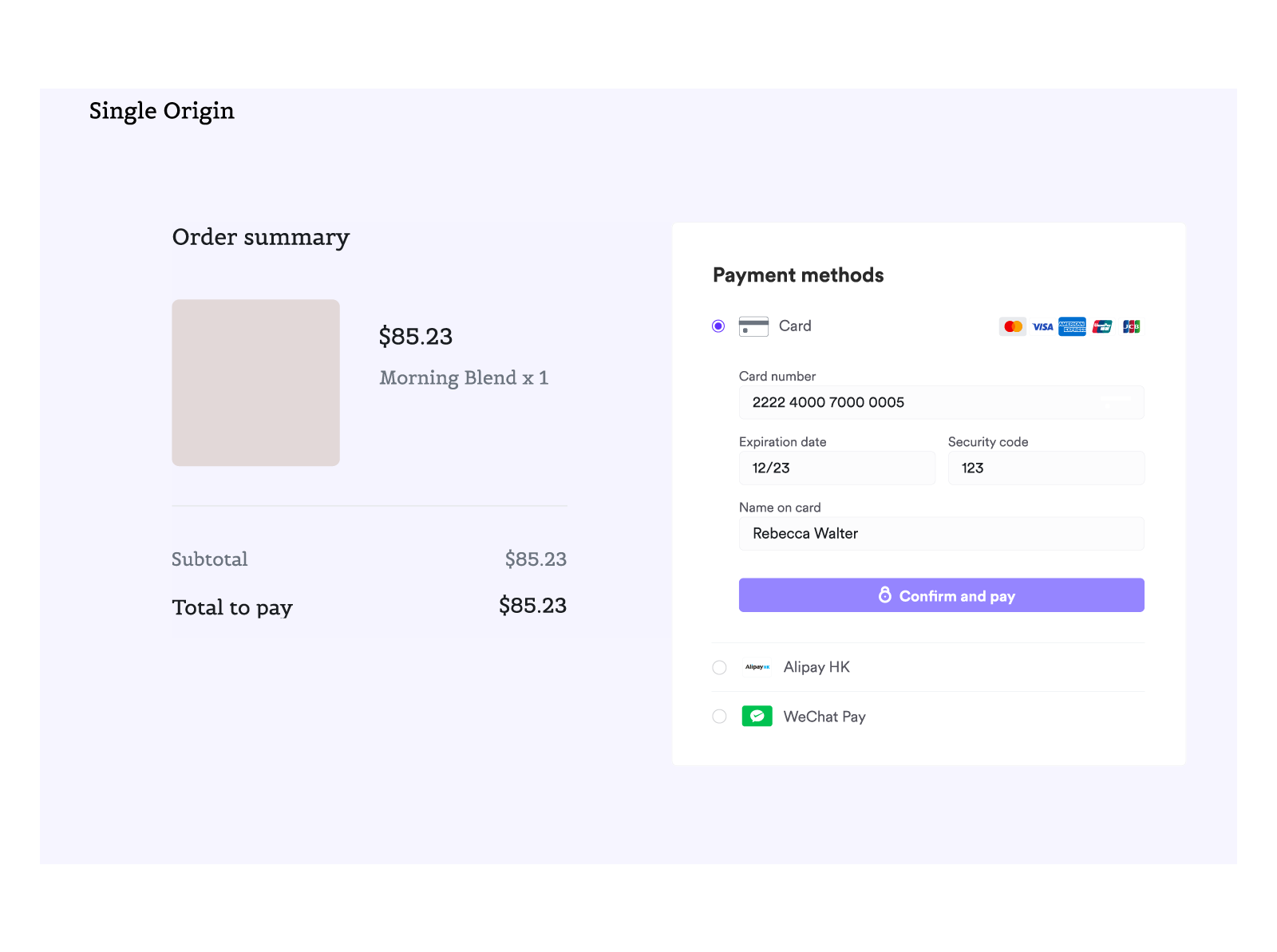

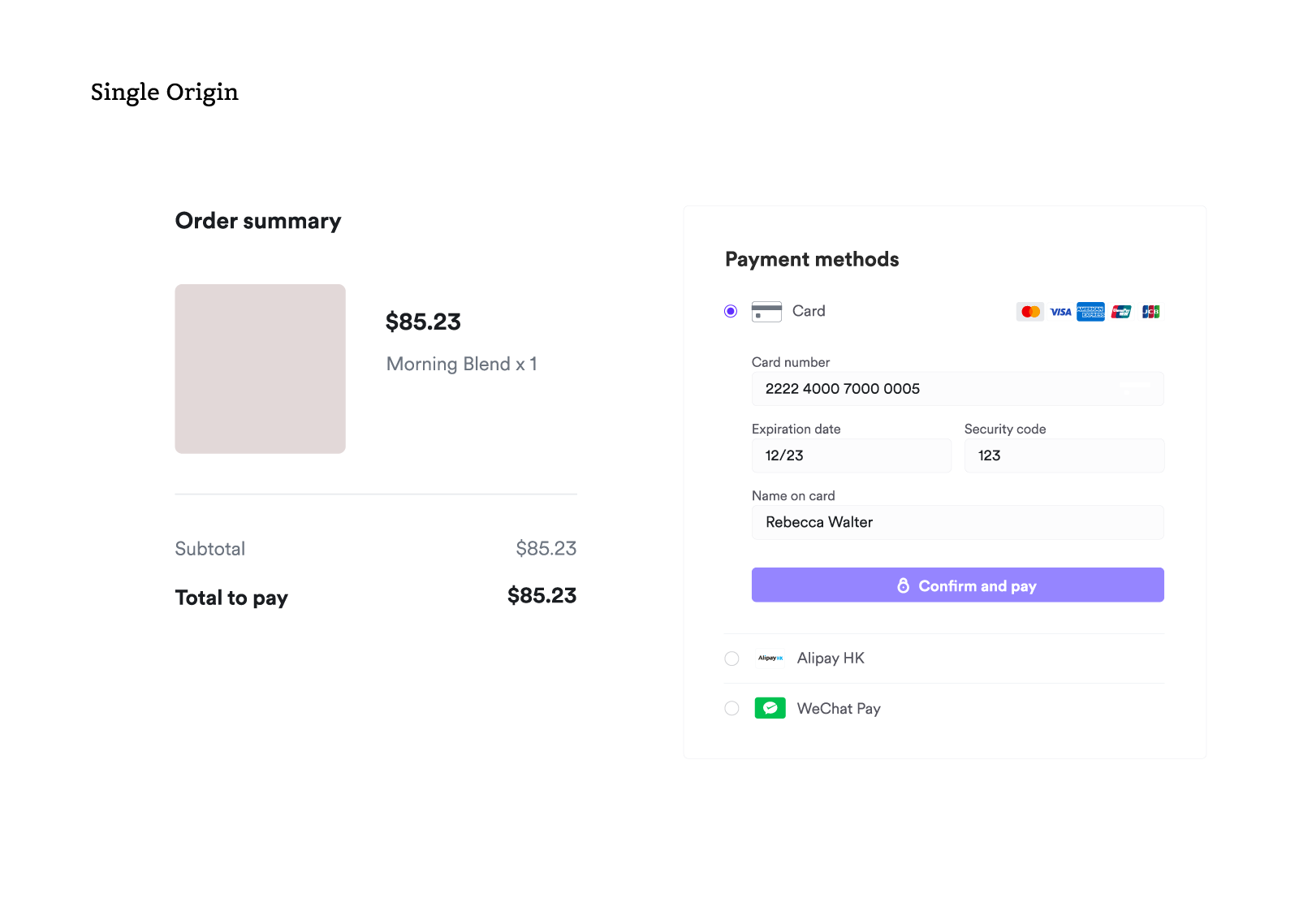

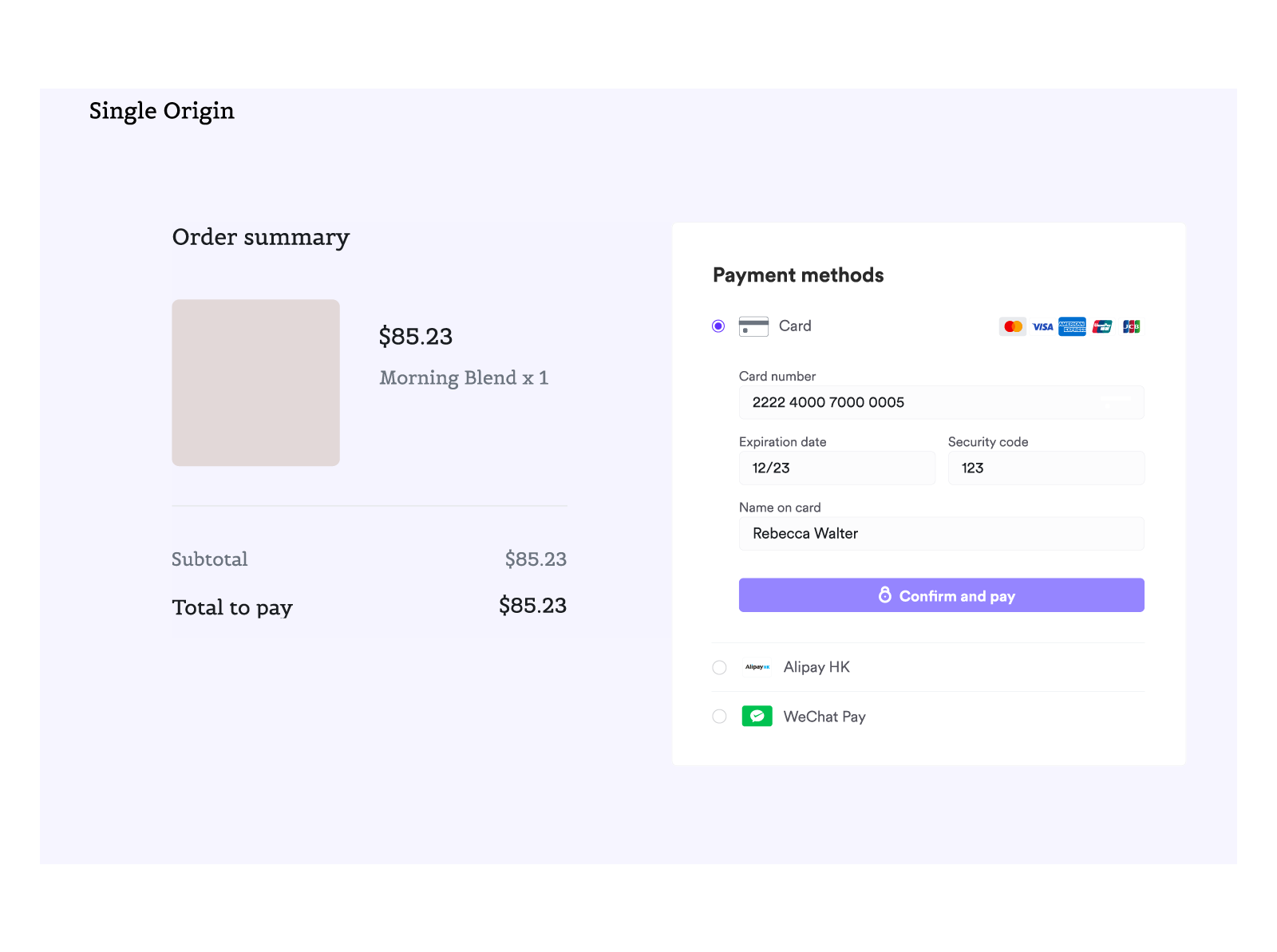

Drop-ins and Embedded Elements

Use our pre-built UI components to easily design and show a unified payment method list on your checkout page or show payment methods separately under different blocks. -

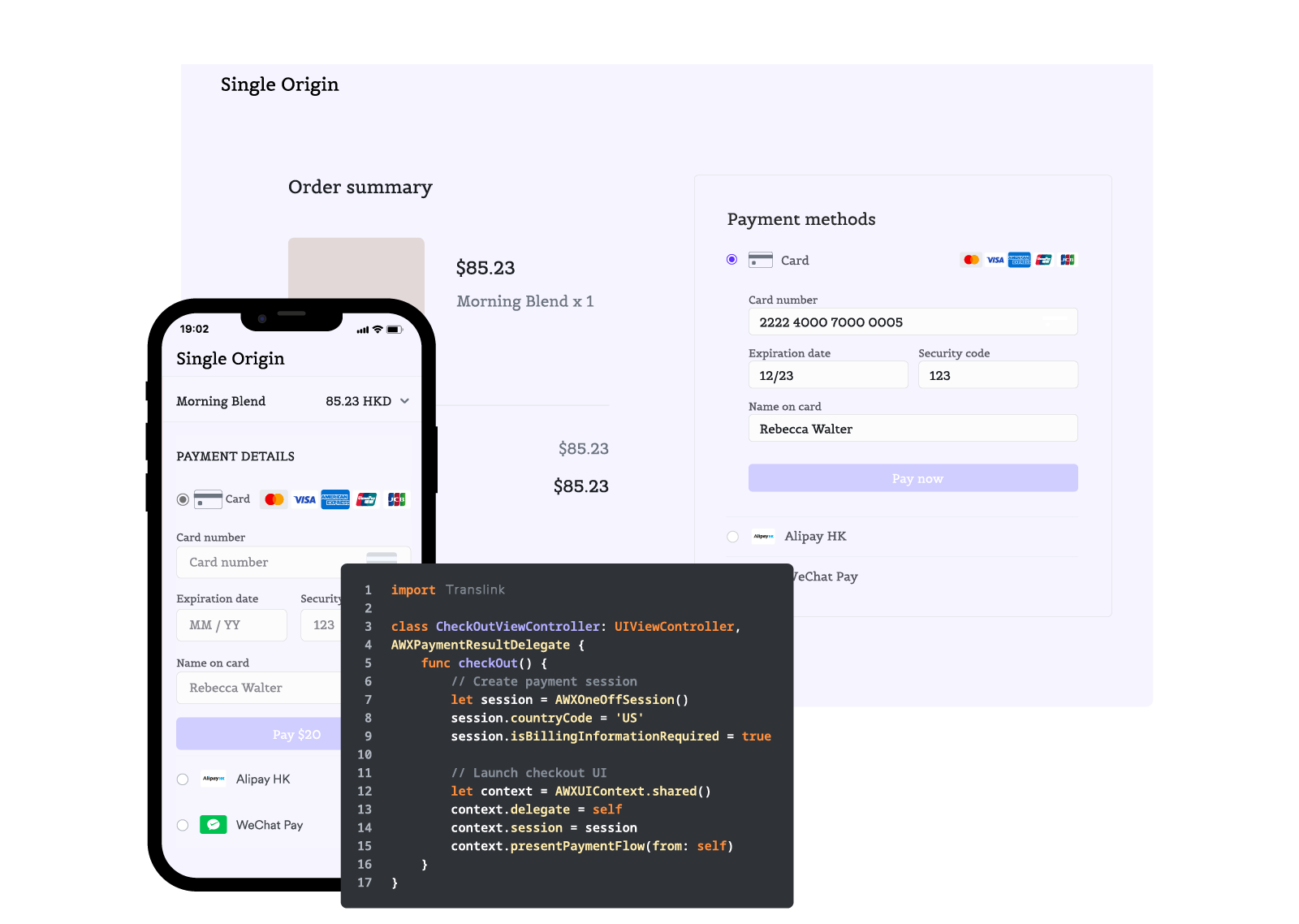

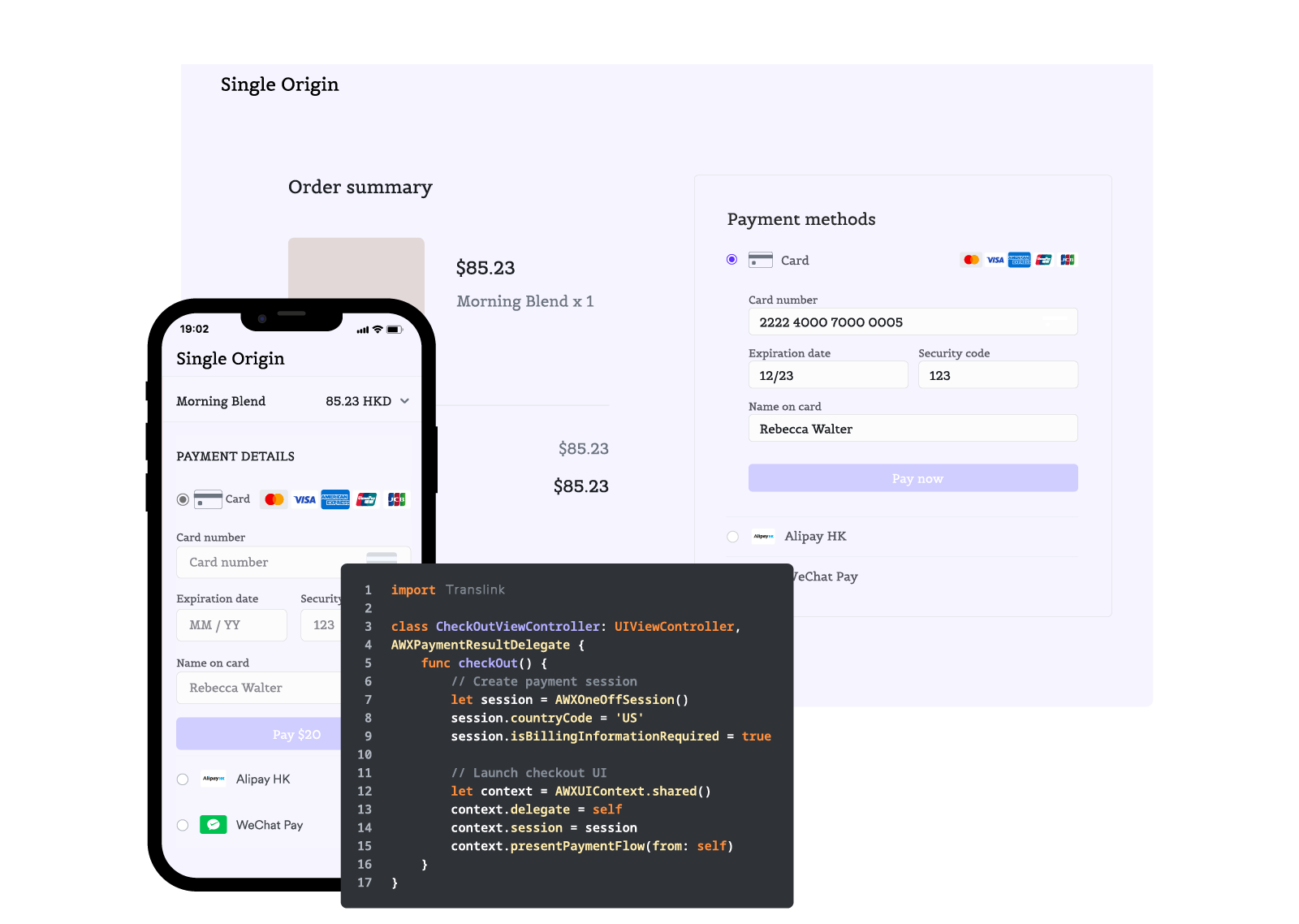

API or Mobile SDK

Take full control over your checkout experience by building directly via our API in the back end or accept payments in your iOS or Android app using our mobile SDKs.

No-code E-commerce Plugins

Access our simple plug-and-play integrations with popular platforms like Shopify, WooCommerce, and Magento.

Hosted Payment Page

Save on development resources by redirecting customers to an Translink-hosted page on your own web store. We take care of the whole payments journey.

Drop-ins and Embedded Elements

Use our pre-built UI components to easily design and show a unified payment method list on your checkout page or show payment methods separately under different blocks.

API or Mobile SDK

Take full control over your checkout experience by building directly via our API in the back end or accept payments in your iOS or Android app using our mobile SDKs.

Frequently asked questions

A payment gateway is a secure online service that enables your customers to use various payment methods for transactions with your business. While payment gateways are common in E-commerce, most platforms carry high foreign exchange and transfer fees for both merchants and customers. Built for the global economy, Translink is your solution to access new markets without the burden of excessive fees.

Payment gateways are crucial for any online business. They simplify, speed up, and secure the purchasing process for your customers. Without one, you'd still be collecting cheques from the post office.

A multi-currency payment gateway allows businesses to seamlessly transact with customers from different countries—without sacrificing a large portion of your profits to fees.

A trusted payment gateway provider is essential to safeguard your global transactions and protect your customers' payment data.

With a Translink multi-currency payment gateway, you can rest assured that our industry-leading security features have you covered. Our technology complies with the highest international security standards.