Securely accept payments worldwide

Accept payments from customers around the world via their preferred payment methods with no coding required. Easily integrate with popular e-commerce platforms or create shareable payment links in just minutes.

Minimise your fees, maximise your conversions

Translink makes it easy for you to securely accept payments from customers around the world, without any unnecessary fees. Integrate with popular global e-commerce platforms or configure and share your own payment links.

-

Save on costly processing fees Enjoy hyper-competitive processing fees on both domestic and foreign transactions.

-

Eliminate unnecessary FX conversion fees Settle payments in 10+ currencies to avoid forced currency conversion and enjoy bank-beating FX rates when there is a need to convert currencies.

-

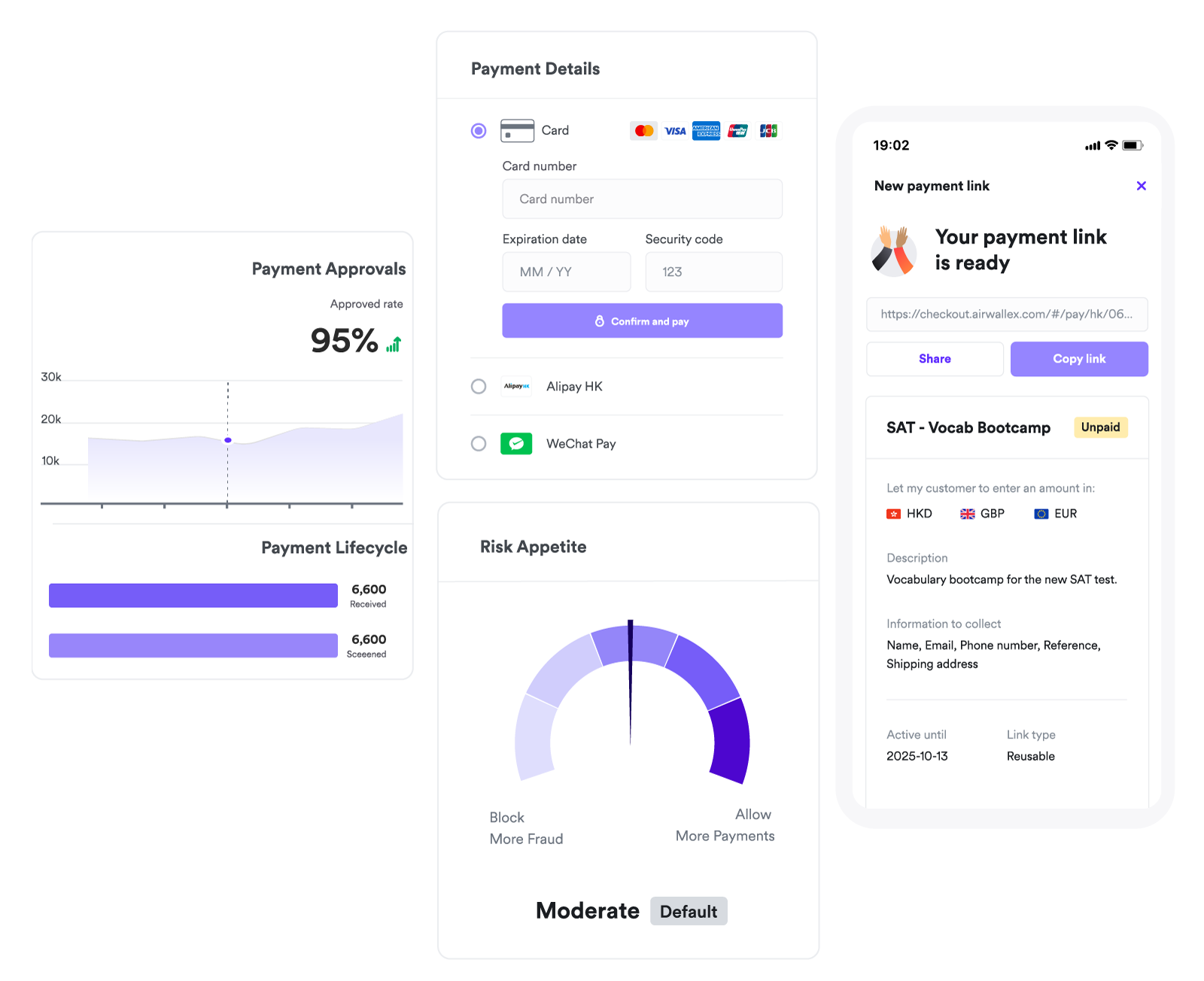

Boost conversion rates with always-on optimisation Benefit from our machine-learning powered optimisation engine that constantly works in the background to improve payment success rates.

-

Attract and convert more customers globally Accept payments from customers in 180+ countries and regions through a variety of payment methods, including popular local options.

-

Safeguard against fraud with our 3DS engine Customise your risk appetite, set custom rules, build alerts lists, and have the option to do manual reviews when needed.

Connect with your existing e-commerce platform

-

Get up and running in minutes Tap into no-code plug-and-play integrations with popular platforms like Shopify, Magento, WooCommerce, and more.

-

Say goodbye to costly conversion fees Collect and settle in the same currency to avoid forced currency conversion and expensive FX fees that eat away at your margins.

-

Increase conversions with local payment methods Allow customers to pay with their preferred payment method, from global cards to popular local non-card options.

-

Streamline end-to-end cash management Accept payments directly into your Translink multi-currency account, convert proceeds at interbank rates if needed, and easily make high-speed transfers to your suppliers around the world.

Accept payments in minutes, without a single line of code

-

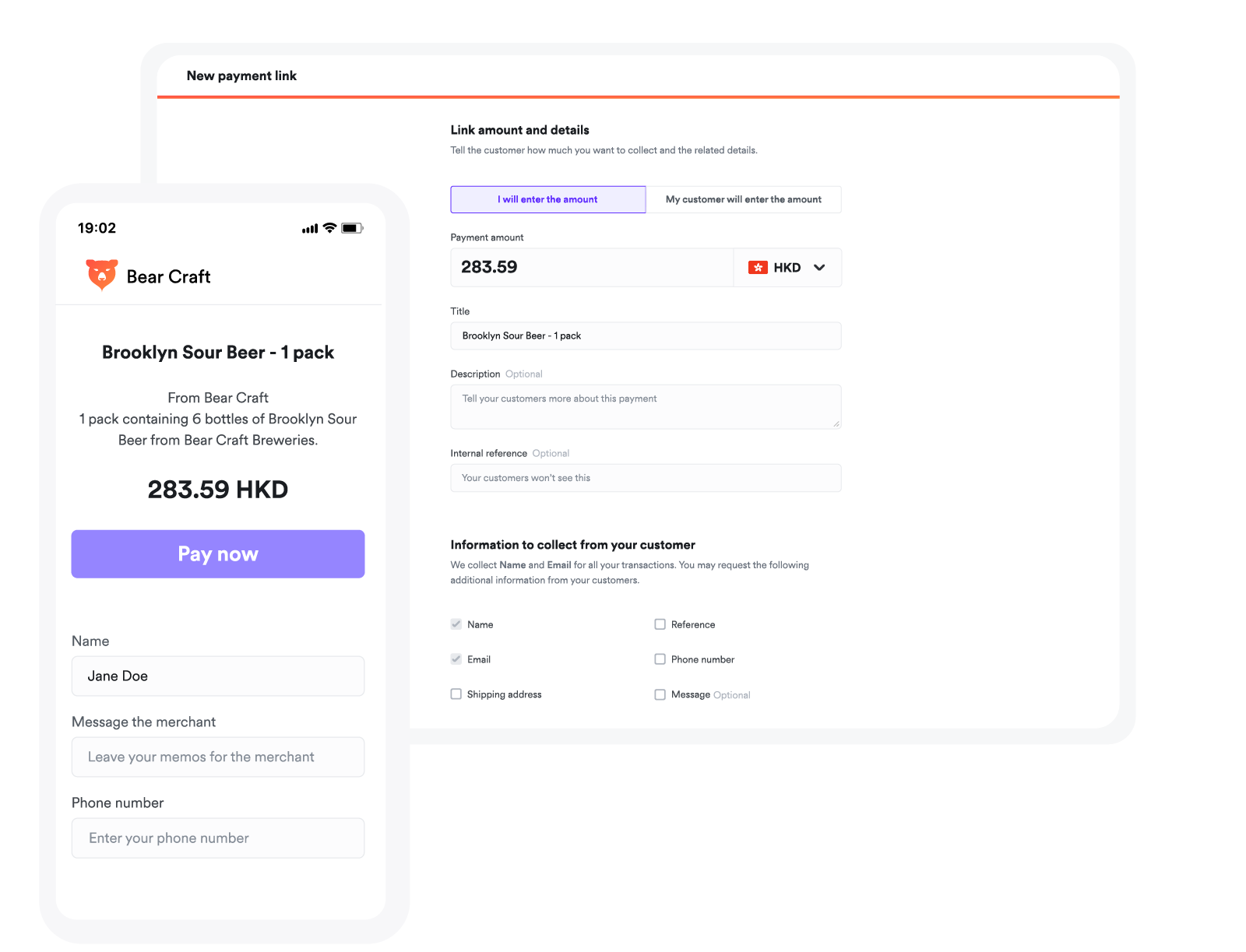

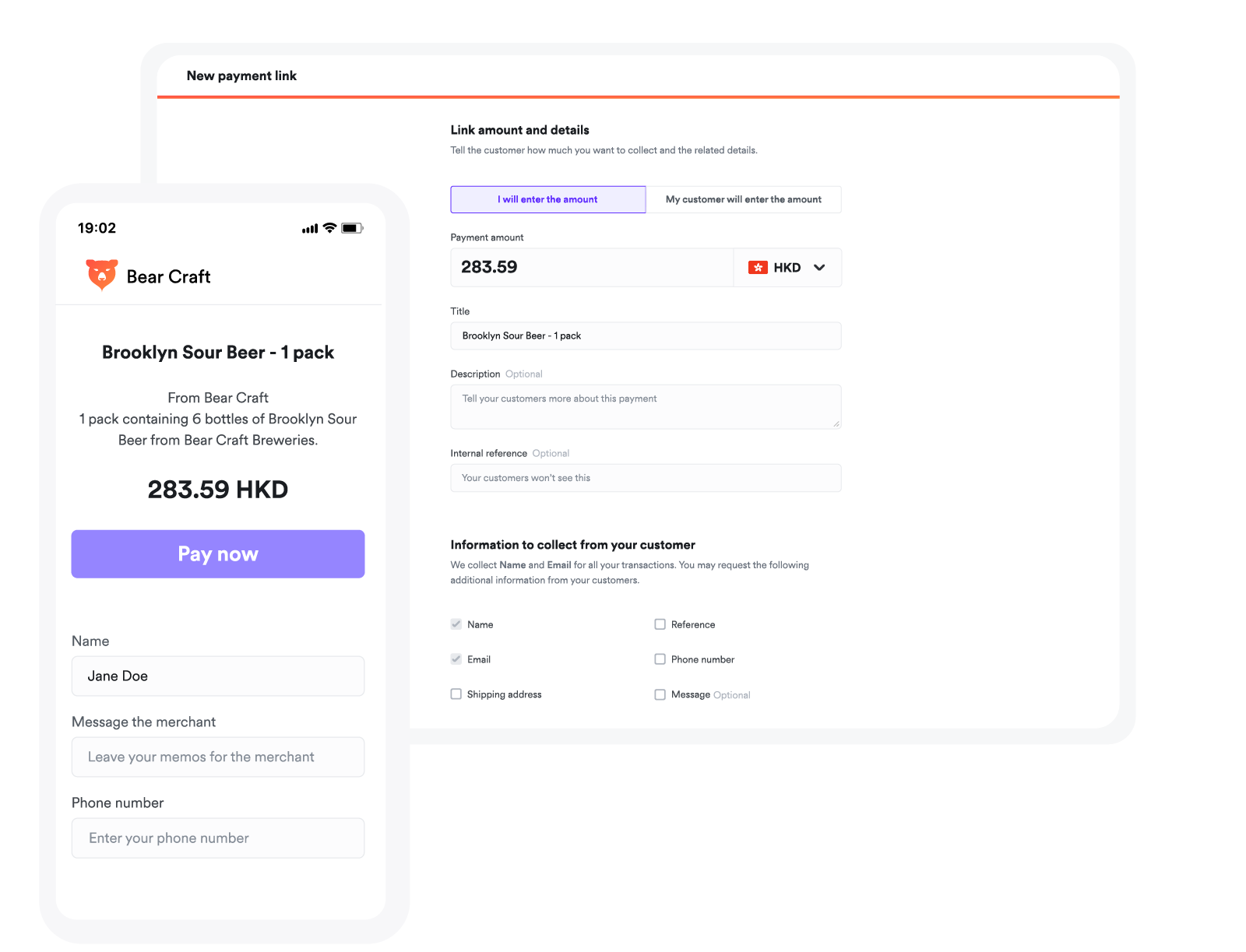

Generate your link

Create a secure one-time or reusable payment link directly in Translink. Download a corresponding QR code if needed. -

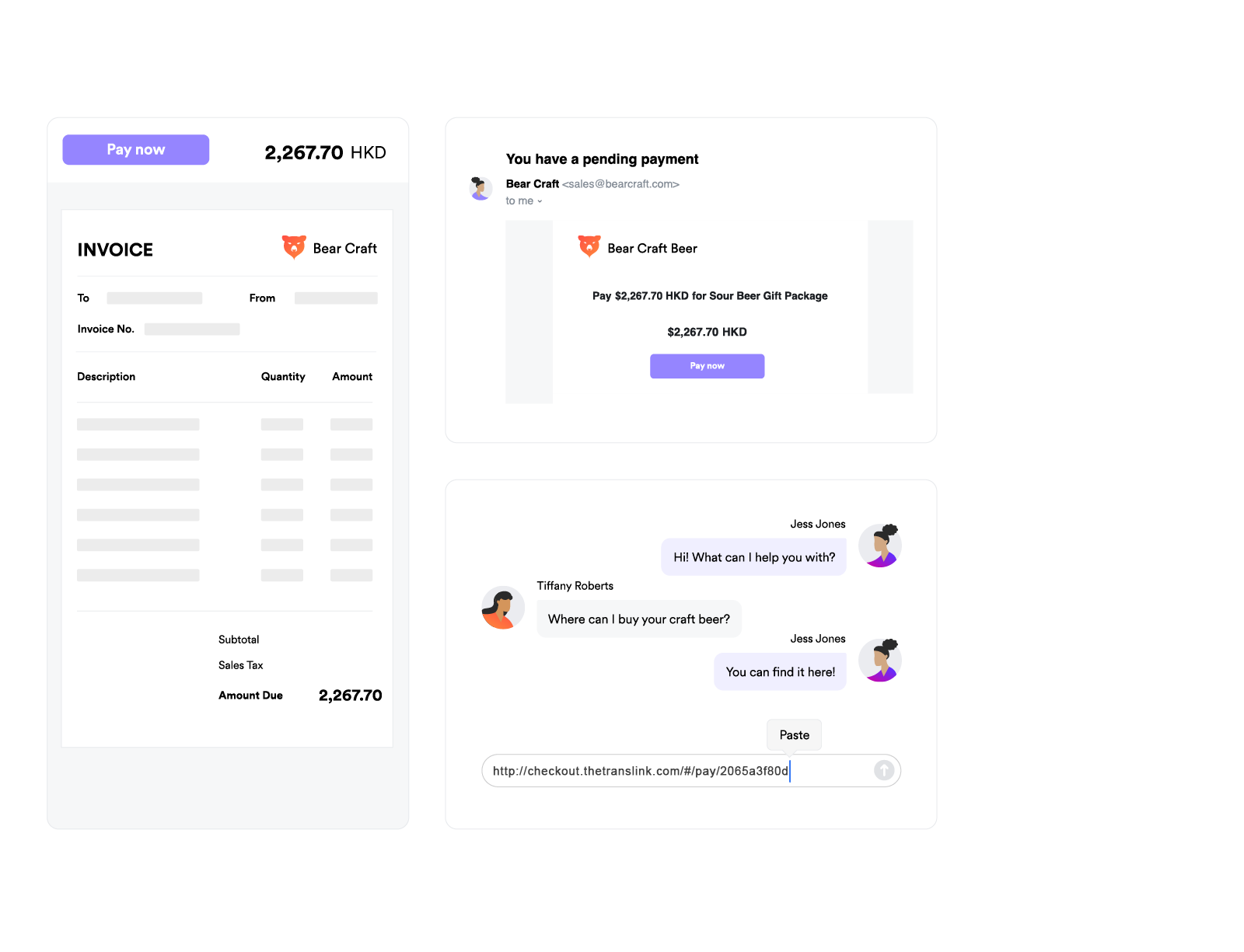

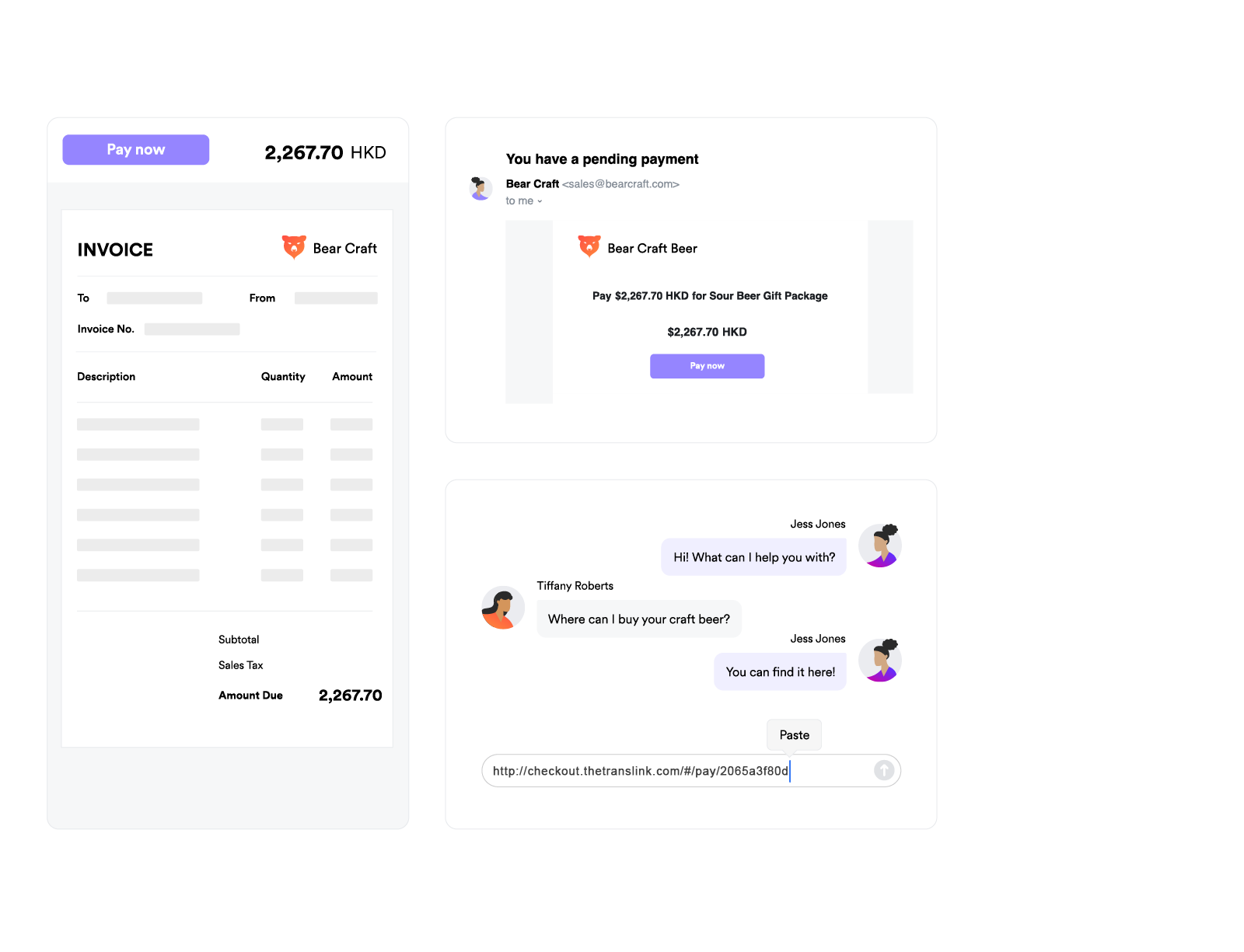

Share your link

Share your payment link or QR code via email, social media, SMS, and more, or embed it into your invoices alongside your branding. -

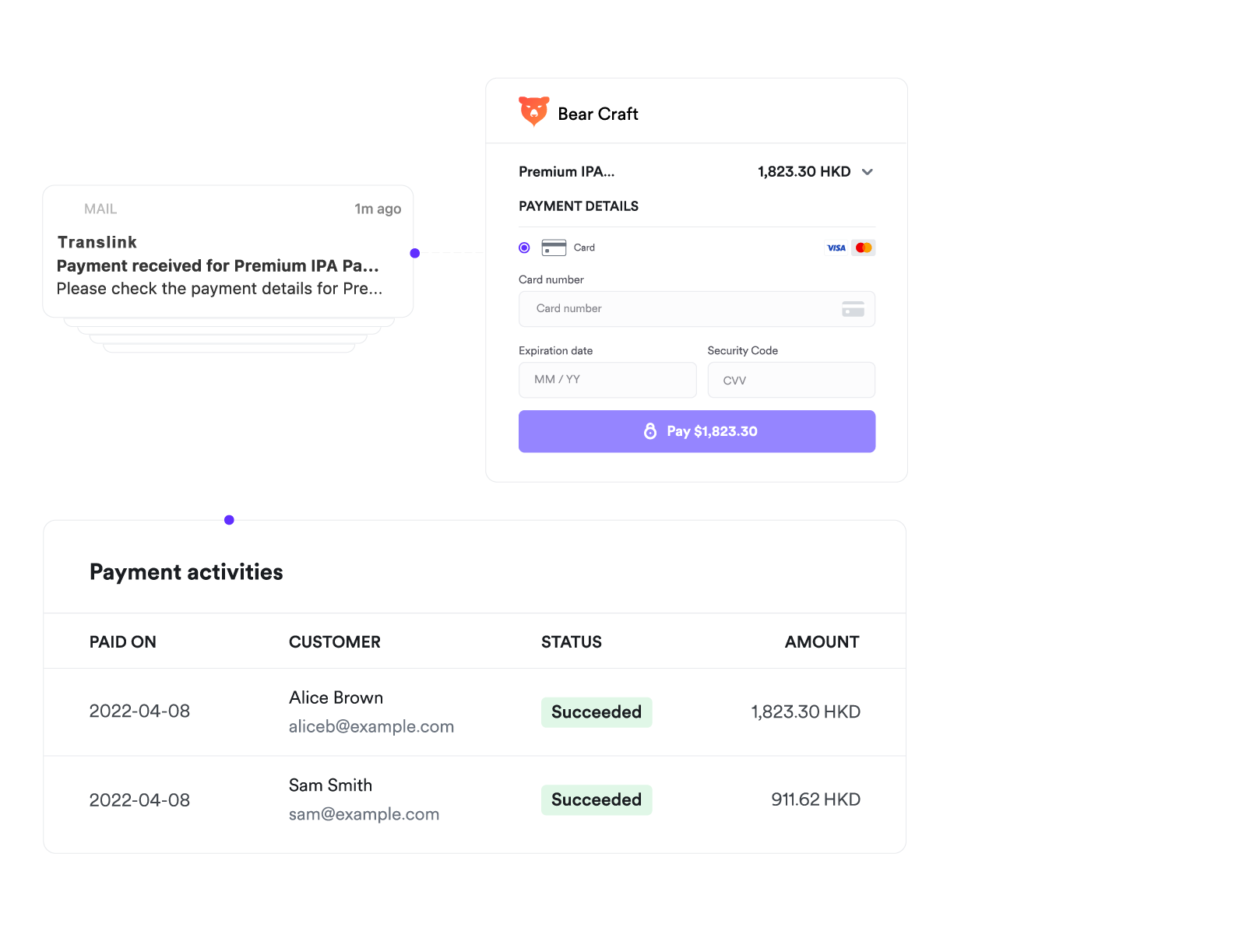

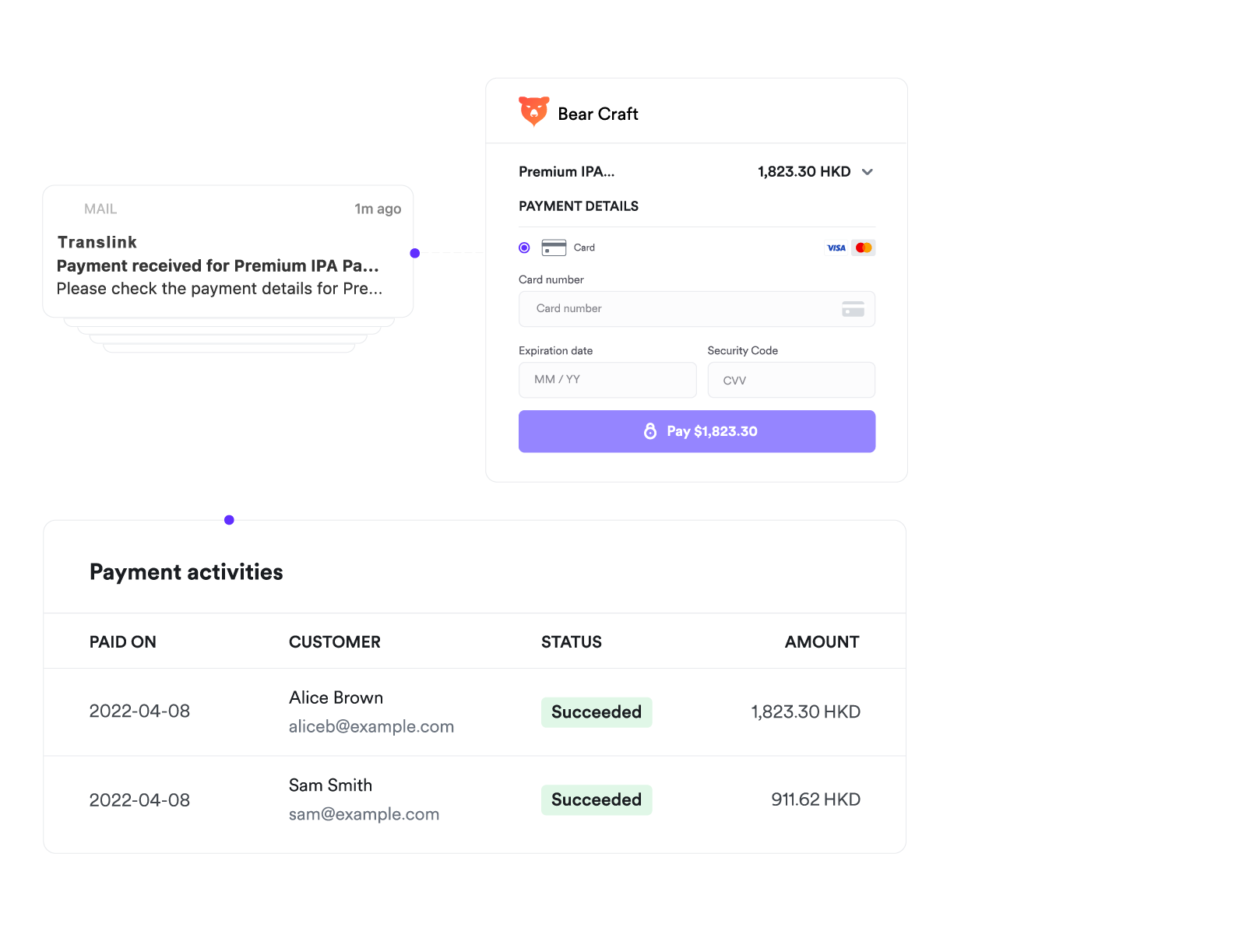

Get paid

Track your payments within Translink and get notified by email when you receive a successful payment.

Generate your link

Create a secure one-time or reusable payment link directly in Translink. Download a corresponding QR code if needed.

Share your link

Share your payment link or QR code via email, social media, SMS, and more, or embed it into your invoices alongside your branding.

Get paid

Track your payments within Translink and get notified by email when you receive a successful payment.

Frequently asked questions

With Translink, you can benefit from ‘like-for-like’ settlement in a variety of currencies. For example, if you have an Australian business that operates a Shopify store with USD store currency, you can receive proceeds in USD directly into your Translink multi-currency account when your customer checks out on your store website and pays in USD. You’ll need to ensure that the payment method offered via Translink supports the specific transaction and settlement currency.

An online payment link is a simple, easy-to-share link you can provide to domestic and international customers so that instant payment is allowed. Your customers can choose from multiple payment methods, including credit and debit cards and a variety of popular local non-card options. Translink Payment Links enable you to accept one-time or recurring payments without any need to write a single line of code. Plus, you'll enjoy flexibility in everything from the customer information you collect to how long your links remain live.

Translink offers a fully-integrated 3D Secure solution that achieves safer online payment links by recognising and verifying cardholders against the issuing bank. With 3D Secure, you can enjoy a frictionless payment experience, while reducing the risk of transaction disputes and fraudulent payments.